Search here

Newspaper

Search here

Arab Canada News

News

Published: April 18, 2024

The Canadian government is planning to expand investment and increase the pace of halal investment in accordance with Islamic law.

The Canadian government is also considering options to broaden access to financing alternatives, including halal mortgages.

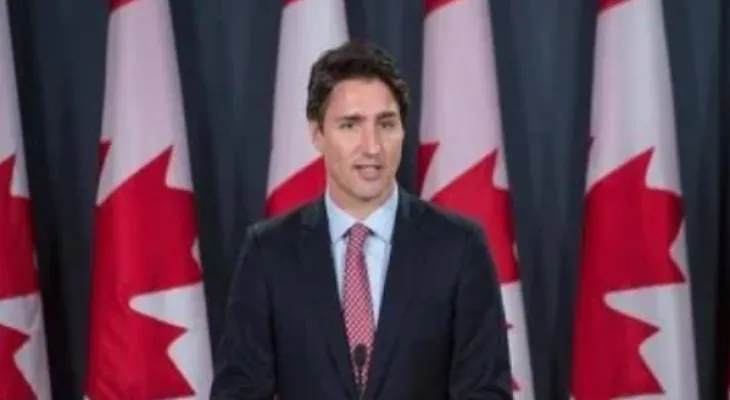

This initiative is part of Prime Minister Justin Trudeau's efforts to support Canadians looking to become homeowners, with a particular focus on the Muslim community.

The Liberal government revealed in the recent federal budget that it has begun consultations with financial service providers and various communities to better understand how federal policies can meet the diverse needs of Canadians seeking home ownership.

The 2024 budget may include changes to the tax treatment of these residential products or introduce new regulatory protections for financial service providers, ensuring adequate consumer protection.

Halal mortgages comply with Islamic law, which prohibits the imposition of interest, considering it a form of usury.

While other Abrahamic religions, such as Judaism and Christianity, also view usury as a sin, Islamic financial institutions uniquely offer mortgage and lending products that avoid traditional interest payments.

Although some Canadian financial institutions already offer Sharia-compliant mortgage loans, none of the country's five major banks currently provide them.

Experts believe that these alternative mortgages may not be entirely free of interest but could involve regular fees as alternatives to interest charges.

Many people on social media have described it as an "enlightened idea" aimed at benefiting one segment of the community; Paul Mitchell wrote: "Religious financial products with different tax treatments? What does that mean?"

The Canadian government imposed a two-year ban on the purchase of residential properties by foreign investors, effective January 1, 2023. The government states that this was imposed to ensure that there are homes for Canadians to live in and not as a speculative asset class for foreign investors.

The government announced in the budget proposal its intention to extend the ban on foreign purchases of Canadian homes for an additional two years, until January 1, 2027.

The budget document mentioned that "foreign commercial entities and individuals who are not Canadian citizens or permanent residents will continue to be prohibited from purchasing residential properties in Canada."

The government projected, among the key points in the housing-focused budget presented by Deputy Prime Minister and Finance Minister Chrystia Freeland, a deficit of $39.8 billion for the 2024-2025 fiscal year.

This budget includes $53 billion of new spending over the next five years, with a large portion aimed at ensuring intergenerational fairness and helping younger Canadians, specifically the millennial generation and the current generation, through programs for renters and first-time homebuyers.

To partially offset the new spending, the government introduced "tax fairness measures," which are expected to generate an additional $18.2 billion in revenue over the next five years.

Comments