Search here

Newspaper

Search here

Arab Canada News

News

Published: March 18, 2022

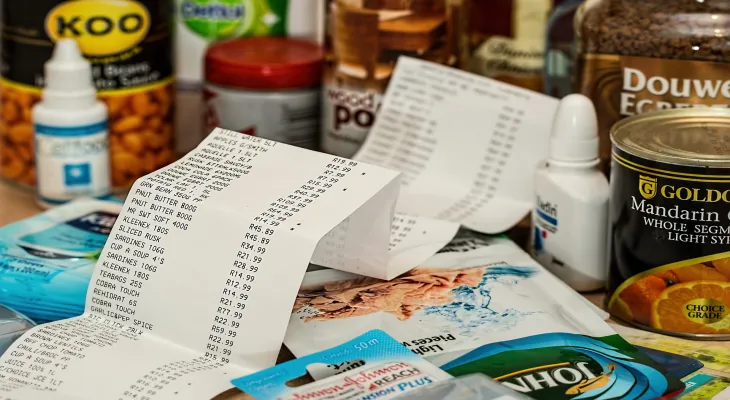

Ottawa - A new poll showed that Canadians are looking for ways to cut spending as their concerns about the cost of living rise alongside key inflation rates.

Four-fifths of respondents to this survey have started or planned to buy cheaper grocery goods to save on food bills, reducing the amount of food they can go without to stretch every dollar.

About three-quarters of respondents to the company said they plan to cut spending on household items and dine out less frequently at local restaurants.

About one in two was already using their cars less to save gasoline as prices at the pumps soared higher than ever, and one in five participants planned to do the same in the near future.

Nearly a third were looking to buy an electric car.

Overall, four-fifths of respondents said inflation had a serious impact on their families, and financial pressure could worsen as inflation rates are expected to rise.

The survey, which included 1,515 Canadians, was conducted between March 11 and March 13, but the margin of error cannot be determined because online panels are not considered truly random samples.

Statistics Canada reported this week that the annual inflation rate in February reached 5.7 percent, a year-over-year increase in the consumer price index not seen in 31 years.

The key rate is expected to rise to nearly six percent by the time the March figure is calculated as Russia's unjustified invasion of Ukraine drove global prices for oil and wheat higher.

Christian Bork, Executive Vice President of Leger, said inflation and the situation in Ukraine have become a concern for Canadians, replacing COVID-19.

RBC Economics estimates that high oil prices could cost Canadian households about $600 more annually, or $10 billion overall, to buy the same amount of gasoline they were purchasing just weeks ago.

The most affected will be low-income households, which usually spend a larger share of their income on necessities like food and energy.

The RBC report said: "For them, rising costs are almost inevitable." "With the spread of government support for the pandemic, any accumulated pandemic-related savings will run out quickly."

Borky said planning to drive less might only help home financing margins, noting that suburban workers will still have to commute as more employers continue plans to return to the office.

He said there could also be negative public health effects if Canadians, as the survey indicates, avoid high-priced fruits and vegetables for less healthy but cheaper options.

Bork said the financial health of families is also a concern.

While two-thirds of Leger survey respondents said their family's financial situation was good, nearly many of them indicated their earnings have not kept pace with price increases, creating a gap in purchasing power.

Borky said: "For me, the biggest concern is how this will actually affect people's ability to pay all their bills."

In an attempt to ease inflation rates, the Bank of Canada raised the key interest rate to 0.5 percent this month, the first increase since lowering the policy rate to an emergency low at the start of the pandemic.

Governor Tiff Macklem predicted more increases in the future, and economists expect the next jump to land in mid-April at the bank's scheduled next interest rate announcement.

By raising rates, borrowing costs increase, which may reduce consumer demand for a variety of goods, including homes and cars, as well as the pace of price increases.

In its updated forecasts this week, TD Economics expected inflation rates to gradually slow down over the course of this year but are unlikely to reach the central bank's 2 percent target until mid-next year.

Nearly nine out of ten participants in this survey expected interest rates to rise, with a third of those anticipating significant hikes in the next six months.

Among respondents, nearly two-thirds said that rising interest rates would be a serious problem for their families to manage.

Comments