Search here

Newspaper

Search here

Arab Canada News

News

Published: November 6, 2022

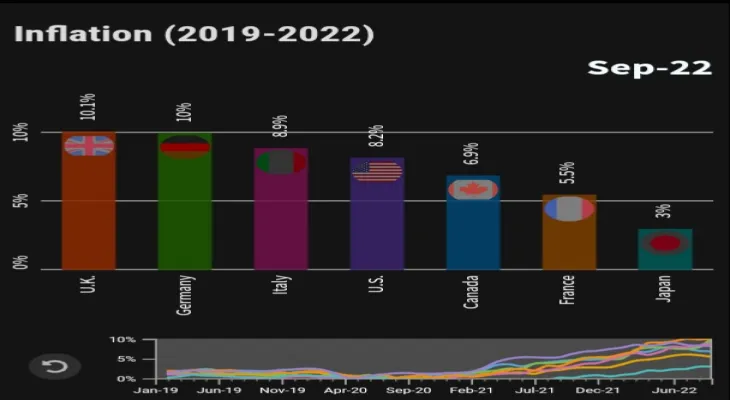

With inflation rates rising to their highest levels in decades, central banks in the G7 countries rushed to raise interest rates—some more aggressively than others. However, despite the deliberate increases, data shows that successive interest rate hikes may not do much to reduce elevated inflation rates to pre-pandemic levels.

Most G7 countries, except Japan, were also aggressive in raising interest rates amid expectations of a possible recession. The Bank of Canada raised the interest rate to 3.75 percent from 3.25 percent, while Canada is expected to experience a potential recession in the first half of 2023, according to its latest monetary policy report.

Likewise, the U.S. Federal Reserve was the most aggressive regarding interest rates. In January 2022, its policy rate ranged between zero and 0.25 percent, but the latest rate in November ranges from 3.75 to 4 percent. While the Federal Reserve raised interest rates by 75 basis points, the Bank of England raised the rate to 3 percent from 2.25 percent—the highest rate since 1989—warning that the UK economy may not grow for another two years.

Also, Germany, Italy, and France face the same interest rate as the European Central Bank recently raised the interest rate to 2 percent in November from zero in January of this year. The average inflation rate in the G7 rose to 7.7 percent.

Additionally, recent data issued by the International Governmental Organization for Economic Cooperation and Development (OECD) shows that the average inflation in the G7 countries reached 7.7 percent in September, up from 7.5 percent in August 2022. The OECD said in the statement: "This increase occurred despite a slowdown in energy price inflation in all G7 countries except Germany."

In the same context, the inflation rate—excluding food and energy—increased in all G7 countries except France. However, it rose significantly in Germany, according to the OECD report. Inflation in food and energy prices continued to drive overall inflation in France, Germany, Italy, and Japan.

The cost of living crisis, tight financial conditions, the Russian invasion of Ukraine, and the prolonged COVID-19 pandemic are all factors severely impacting growth expectations for the G7. According to the Bank of Canada's monetary policy report, GDP growth is expected to slow to between 0 and 0.5 percent until the end of 2022 and the first half of 2023. Bank of Canada Governor Tiff Macklem said during a press conference in October: "What this means is that, yes, a couple, two, three quarters of slight negative growth are just as likely as two or three quarters of slight positive growth, October 26, 2022. This is not a sharp contraction, but it is a significant economic slowdown."

Latest global economic growth forecasts have declined for nearly all G7 countries (except Japan), according to the recent report from the World Economic Outlook issued by the International Monetary Fund. To restore price stability, the pace of tightening accelerated sharply by central banks in the G7. However, IMF experts warned of the risks of both under-tightening and over-tightening.

Raising interest rates is a delicate balancing act, and sharp rate hikes like those that occurred in the 1980s led to recessions. In contrast, slow response to inflation erodes central banks' credibility, allowing prices to remain high for longer and prompting people to buy more, expecting prices to continue rising.

At a press conference on June 15, 2022, U.S. Federal Reserve Chair Jerome Powell said, "There is always a risk of going too far or not far enough, and it will be an extremely difficult judgment."

Comments