Search here

Newspaper

Search here

Arab Canada News

News

Published: March 13, 2023

Banks seem to be the safest places to keep your money, but this place faces various crises for multiple reasons, which may put depositors' money at risk.

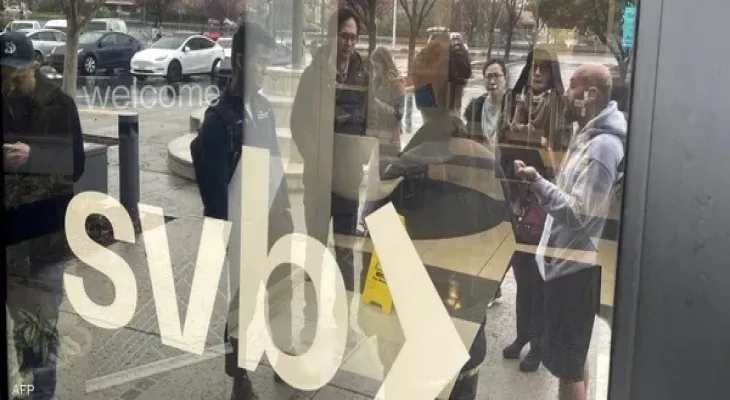

The shadow of the global financial crisis that struck in 2008 looms since Friday, with the announcement of the bankruptcy of the American "Silicon Valley" bank, meaning it became unable to fulfill its obligations, including providing cash to its customers.

The tragic bankruptcy of the Silicon Valley Financial Group, a group focused on technology startups, on Friday is the largest bank collapse in the United States since the 2008 financial crisis.

Silicon Valley Bank, headquartered in Santa Clara, California, ranks sixteenth among the largest American banks with assets valued at $209 billion, which makes the list of potential buyers who can execute a deal to buy it relatively short.

Concerns escalated with the announcement by the New York State Department of Financial Services on Sunday that it had taken over "Signature Bank" and placed the Federal Deposit Insurance Corporation as receiver.

This is the second bank bankruptcy within days.

There seem to be 10 main reasons for bank bankruptcies according to the American site "MIC".

Poor loan management: Loans are a major part of banking business, and credit analysis skills are essential in the banking sector, with banks even having extensive training programs to help new lending staff.

But the problem arises when lending standards are negligently reduced and dangerously lowered for more profits, which leads to increased losses and financial problems.

Funding issues: When a bank fails to refinance or repay its debts, it may face collapse. Financing is related to overall market conditions, but it becomes a problem when investors lose confidence in the bank for some reason.

Misalignment between assets and liabilities: When a bank's assets do not match its liabilities, many problems can arise. For example, if interest rates rise, the bank will pay more on its debts while the loans it granted remain at a fixed rate, leading to significant losses if there is poor management of a large portion of the bank’s portfolio.

Regulatory issues: When authorities sanction foreign banks, this removes them from operating in the United States, due to banks being involved in illegal activities such as money laundering or operating in sanctioned countries.

Ownership trading: Companies and businesses owned by banks often generate significant profits, but financial sector regulators believe there is a high likelihood of major losses, especially in high-risk investments such as securities ownership.

Non-banking activities: Over the years, to boost profits, banks engaged in unconventional activities such as real estate investment funds and consumer finance companies that were largely unsuccessful and resulted in significant losses.

Risk management decisions: Large banks have strict and periodic procedures regarding risks around the bank’s portfolios, considering all visible risks including interest rate risk, foreign debts, investments, and others.

When there are errors in measuring these risks with significant market movement, large losses are likely to occur.

Disproportionate loans to bank employees: This happened in the 1980s when many banks worldwide lent their managers and employees money to buy property or finance unstudied projects, which eventually led to large losses.

Employee violations: Some employees bypass the applicable regulations, exposing banking institutions to large losses or damaging the bank's financial standing.

Insurance does not cover: Insurance covers depositors' money in the United States up to a certain amount, but in other parts of the world, the risk exists, and if these depositors demand all their money, the bank is likely to collapse.

Comments