Search here

Newspaper

Search here

Arab Canada News

News

Published: April 21, 2023

Earlier this year, the Canadian government presented the 2023 budget, presenting it as a plan to build a stronger, more sustainable, and safer Canadian economy.

One of the main points that this year's budget focuses on is affordability, and how the government can make life cheaper for Canadians.

From enhanced support for students to a new tax-free first home savings account and a grocery discount, the federal government has put forward a number of strategies that they say will ease some of the pressure on Canadians' pockets.

Here is a look at some of the key inflation relief support measures outlined in the latest budget, get to know them:

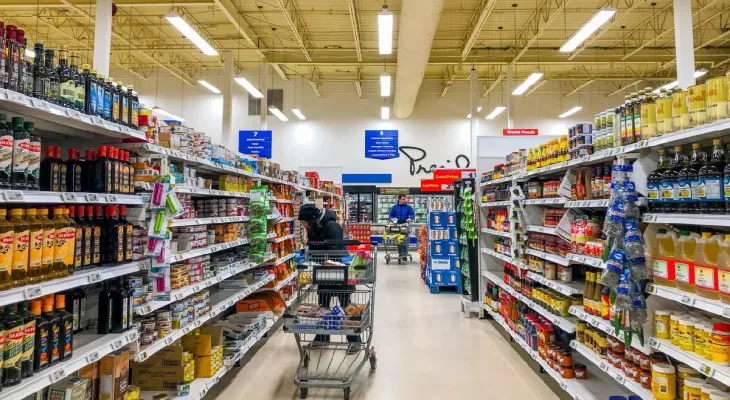

Grocery discount:

One of the most talked-about announcements to come out of the 2023 federal budget is the new grocery discount.

Under the current plans, the one-time payment will provide targeted inflation relief for up to 11 million low- and middle-income Canadians and households.

The plan offers up to $234 for a single person with no children, up to $467 for couples with two children, and about $225 for seniors.

The expected cost of implementing the discount is about $2.5 billion.

Combatting unwanted fees:

The other way the federal government says it will make life cheaper is by taking tough action against so-called "unwanted fees."

As part of this year's budget, the government has committed to stronger action on unexpected, hidden, or additional fees, such as excessive internet fees, roaming charges, event and concert fees, and excess baggage fees.

It explained that it will work with regulators, provinces, and territories to address these unwanted fees, so Canadians pay less for the services they often receive.

The right to repair:

The government stated that high repair fees mean Canadians often end up paying to buy new products instead of repairing what they have.

In an attempt to make repairing products and electronics easier when they break or become damaged, the government says it will work to implement the right to repair, with a specific framework for home appliances and electronics in 2024.

The budget also proposes standardizing chargers, which could mean people with electronics from different manufacturers won’t have to buy multiple different chargers.

Enhancing student support:

This year's budget included more support for students, including increasing Canadian student grants and expanding the interest-free Canadian student loan limit.

As part of the budget, the government says that the rising cost of living still means students need support to afford education costs.

To this end, the budget proposes a 40% increase in the amount students can receive through Canadian student grants.

If approved, eligible students will be able to get up to $4,200 for the school year to help cover expenses.

Changes were also proposed to the Canada Registered Education Savings Plan (RESP), including increased restrictions on certain withdrawals and changes to who can open an account for their children.

Tax-free home savings account:

The First Home Savings Account (FHSA) was launched as of April 1.

The account allows potential first-time homebuyers in Canada to save up to $40,000, with tax-exempt contributions and tax-free withdrawals.

Dental care:

As part of the 2023 budget, the government laid out its plans to continue investing in the new Canadian dental care plan.

It indicated it will move forward with a $13 billion investment in the Health Canada program over five years starting from 2023-24, and $4.4 billion afterward.

The government plans provide dental coverage for Canadians who do not have insurance and whose household annual income is less than $90,000.

The Canadian dental care plan, managed by Health Canada, is also expected to begin providing coverage by the end of this year.

Additional details about eligible coverage will be confirmed later.

Comments