Search here

Newspaper

Search here

Arab Canada News

News

Published: November 28, 2023

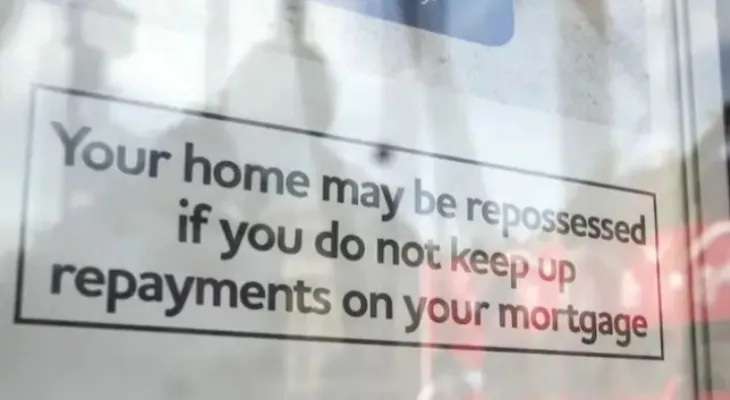

Canadian Finance Minister Chrystia Freeland expects banks to follow a new set of rules and guidelines aimed at protecting Canadian homeowners, millions of whom are forced to renegotiate their loans at potentially higher interest rates.

Freeland said in an interview aired Sunday on the Rosemary Barton Live program: "What I hear most now is that people are worried about interest rates, especially those who have mortgages and are concerned about renewing them."

A report published by Royal LePage indicated that more than three million Canadians will face mortgage renewals in the next 18 months.

This causes concern among homeowners, as some told CBC News that they hope to make significant lifestyle changes to accommodate the increase.

Bekramdeep Singh is one of them. He told CBC News that he expects mortgage payments to increase by 30 to 40 percent when renewal time comes next year.

The owner said earlier this week from Vancouver: "It will be a large amount of money that I will spend every month. It will definitely affect my lifestyle. I will have to make adjustments."

As part of the economic fall statement issued Tuesday, Freeland unveiled the Canadian Mortgage Charter, a non-binding set of guidelines and expectations put in place by Ottawa for banks regarding mortgages.

The charter – which has no legal force – includes measures such as the possibility of temporarily extending repayment periods, ending the stress test when changing lenders at renewal time, and waiving some fees.

Also in response to a question about whether banks can be trusted to follow the guidelines without a clear enforcement mechanism, Freeland said she believes the interests of the government, banks, and Canadians are aligned on this issue.

She reiterated: "I have hope – but also conviction – that banks will work with us and the government and Canadians to fulfill these commitments."

With millions of mortgage renewals approaching at much higher interest rates, the new guidelines aim to help protect homeowners, but some say the measures do not go far enough.

Freeland said it is important for Canadian homeowners to be aware of the rules and what to expect when talking to their banks.

She emphasized that "Canadians need to know this, and that's why I stress it a lot."

Comments