Search here

Newspaper

Search here

Arab Canada News

News

Published: March 30, 2023

The federal government unveiled its spring budget on Tuesday, with a clean economy as the main focus, detailing targeted measures to help Canadians cope with still-high inflation.

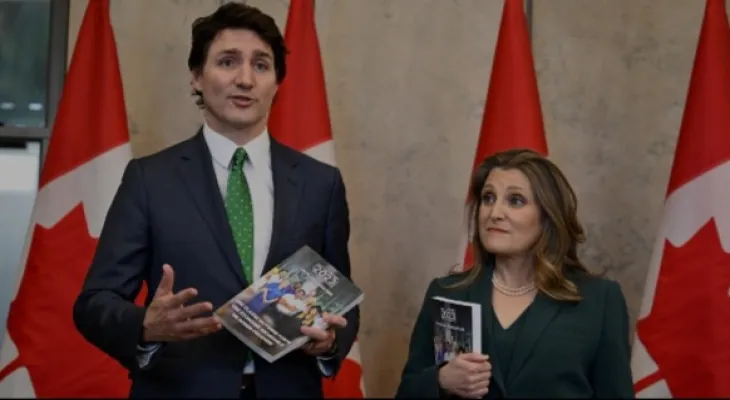

Finance Minister Chrystia Freeland also presented the 255-page budget on Tuesday, after weeks of indicating she would try to balance fiscal restraint and targeted spending for vulnerable Canadians.

CTVNews.ca analyzed the documents to identify the elements that, if passed in Parliament, would have the greatest impact on small businesses, families, students, and seniors in Canada.

While inflation has eased for the second consecutive month – falling to 5.2 percent in February from 5.9 percent in January after its highest levels in 40 years last summer – grocery prices remain high, with a Nanos Research poll showing the economy and inflation remain among Canadians’ top concerns.

Also, with the cost of food in stores rising by 10.6 percent year over year last month according to Statistics Canada, the federal government proposes a new one-time "grocery rebate." According to the budget, about 11 million low- and modest-income Canadians will be eligible for the rebate, delivered through the Goods and Services Tax credit system.

Qualified couples with two children can get up to $467, seniors can get $225, and a single person may be eligible for $234.

The federal government has tightened the noose on predatory loans, with plans to amend the Criminal Code to cap the legally chargeable interest rate at 35 percent. This is to prevent "greedy lenders" from exploiting "some of the most vulnerable people in our communities," according to the budget.

The budget also proposes changes to help Canadians access certain benefits, such as increasing the number of people eligible to have their income taxes filed automatically. According to the federal government, this will help many low-income Canadians who do not currently file their tax returns access "the benefits and support they are entitled to, such as the Canada Child Benefit and Guaranteed Income Supplement."

Additionally, the 2023 budget proposes increasing financial assistance for post-secondary students and measures to help them repay their debts, in an attempt "to make the transition from school to working life easier," because "the federal government knows that high living costs still mean students need support to afford education."

Some additional measures set by the federal government to help students during the COVID-19 pandemic are scheduled to expire at the end of July, so the new measures in the 2023 budget will take effect early August, with budget details planning a 40 percent increase in Canadian student grants, which could mean up to $4,200 for full-time students.

On another front, healthcare is among the largest spending categories in the spring budget, which includes details of the previously announced funding deal between the federal government and provinces and territories, alongside plans to expand the dental care plan. The latter is a key part of the confidence and supply deal between the Liberals and the New Democratic Party, which sees the NDP supporting the Liberals in exchange for progress on certain policies.

In the same vein, the budget will allocate $46.2 billion more than previously designated for healthcare as part of the deal with the provinces and territories to improve patient care and access.

The budget will also set out plans to expand the Canada Dental Benefit – which currently helps cover dental care costs for children under 12 – and earmarks $13 billion over five years to establish a federal dental care plan.

The new plan will also provide dental coverage for uninsured Canadians with family incomes under $90,000 by the end of this year.

Also, responding to the increase in Canadians’ use of credit cards while shopping, the Liberals are promoting plans in the budget to help small business owners, namely by working with some credit card companies to cut transaction fees.

Visa and MasterCard have committed to lowering fees for small businesses, "while protecting reward points too," which means over 90 percent of businesses that accept credit cards will see their fees cut by up to 27 percent.

Comments