Search here

Newspaper

Search here

Arab Canada News

News

Published: October 19, 2022

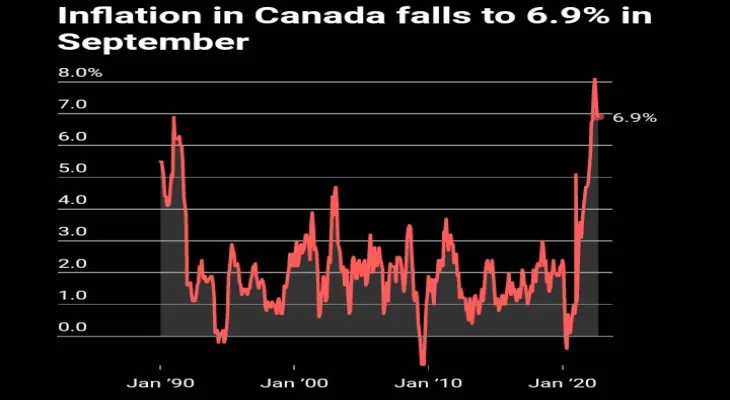

The latest Canadian reading on inflation came in higher than expected as grocery prices continued to rise at the fastest pace in decades, paving the way for another interest rate hike next week. In the latest Consumer Price Index report, Statistics Canada said the country's annual inflation rate in September eased slightly to 6.9 percent from 7.0 percent in August. BMO's Chief Economist, Douglas Porter, also said the slowdown in core inflation was less than expected, adding: "Frankly, inflation hasn't come down as much as expected last month, even with gasoline prices retreating a big step back." With core inflation pressures persisting and the Bank of Canada signaling it will not back down from raising interest rates so far, BMO expects the central bank to raise the key interest rate by three-quarters of a percentage point next Wednesday. Likewise, Statistics Canada attributed the slower pace of price growth to a drop in gas prices. Pump prices fell by 7.4 percent in September from August. With gas prices down, grocery prices rose at the fastest rate since August 1981, with prices up 11.4 percent compared to last year. Also, the slight dip in the core inflation rate resembles what the United States saw in September, with the core inflation rate falling from 8.3 to 8.2 percent. Furthermore, with gas prices falling in recent months, Tombe said the main driver behind rising inflation is now fading. Tombe added that the recent weakness of the Canadian dollar may continue to push grocery prices higher as Canada imports some of its food. In the same regard, the federal agency said the rapid rise in grocery prices is due to weather conditions, increased prices for fertilizers and natural gas, and the Russian invasion of Ukraine. With September marking the beginning of the school year for many students, Statistics Canada noted that tuition fees rose by 2.3% compared to last year. Excluding food and energy, prices rose by 5.4 percent year-over-year, a slight acceleration compared to August. On a monthly basis, the Consumer Price Index increased by 0.1 percent. Additionally, rising prices over the past year have eroded the purchasing power of many Canadians as wages have lagged behind inflation. Average hourly wages rose by 5.2 percent in September compared to last year, below the rate of inflation. The Bank of Canada will monitor the latest consumer price index data ahead of the next interest rate announcement, closely watching its preferred core inflation measures. The Bank of Canada is also expected to deliver another rate hike next Wednesday, with forecasters split between a half and three-quarter percentage point increase. The central bank, which has a mandate to maintain low and stable inflation rates, is fighting high inflation by raising interest rates. Since March, it has raised the key interest rate five times this year, increasing it from 0.25 to 3.25 percent. Higher interest rates feed into higher borrowing costs for Canadians and businesses, as the Bank of Canada aims to slow spending in the economy enough to bring inflation back to its 2 percent target. However, reaching that goal will take some time, as the full impact of these rate hikes will not be felt for another year or two.

Comments