Search here

Newspaper

Search here

Arab Canada News

News

Published: January 1, 2024

Exemptions from the Goods and Services Tax/HST, the end of short-term rental discounts, and the rising cost of the Canada Pension Plan (CPP) contributions are among the new measures for 2024.

These new tax measures and changes to existing procedures will begin to affect Canadians in 2024. However, tax experts say the impacts on most individuals are likely to be minor, unless they are high-income earners.

The exemptions from the Goods and Services Tax/HST, the cancellation of discounts on some short-term rentals, new alternative minimum tax rates, and changes in Canada Pension Plan (CPP) contributions are among the upcoming new measures in 2024.

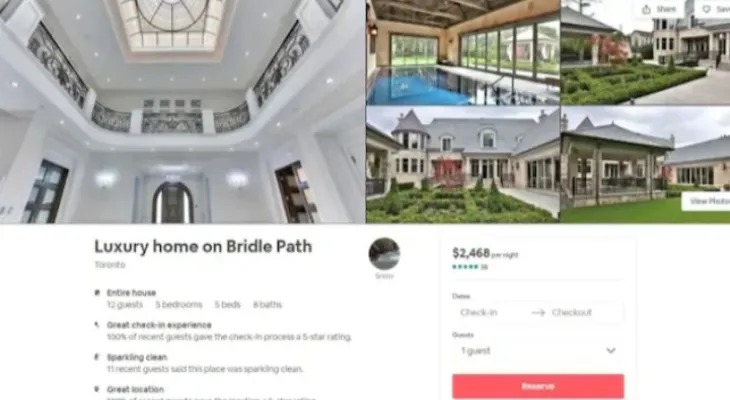

- Cancellation of short-term rental discounts:

The cancellation of some short-term rental discounts was announced in the Fall Economic Statement (FES) and will take effect on January 1.

When the federal government announced this change, it justified the move by saying that in Montreal, Toronto, and Vancouver in 2020, there were nearly 19,000 homes operated as short-term rentals that could be used for permanent housing.

To encourage owners to return those units to the long-term rental market, some municipalities imposed bans on short-term rentals, while others applied restrictions on how they operate. Despite the bans and restrictions, some owners continued renting these properties.

Under these circumstances, where the province or municipality banned rentals in certain areas—yes, they are banned [but] if you continue to engage in these activities, [said] the federal government... you must pay taxes on them, said Amir Abdullah, partner at EY private.

The federal government has also now canceled this tax exemption, depriving short-term rental operators of any income tax deductions for expenses if they operate in provinces or municipalities that have banned short-term rentals.

In provinces that still allow short-term rentals, operators who do not comply with local regulations and laws will also be denied the deduction.

Abdullah said this is just another deterrent put in place by the federal government for this current framework.

Goods and Services Tax exemptions:

In FES, the federal government announced it will remove the Goods and Services Tax/HST from professional services provided by psychotherapists and counseling therapists.

The government said it is making this change to help ensure Canadians can afford the care they need.

Also, according to the Parliamentary Budget Officer (new release), this measure will cost $64 million in lost revenue over five years.

For his part, Daniel Rogozinski, co-director of the Master's degree in Accounting at the University of Waterloo, said that if you really look at their goal, they are trying to use the income tax system to encourage people to do socially beneficial things.

Rogozinski said making services affordable tends to increase demand for those services. That could pose a problem in Canada, where the demand for mental health services exceeds supply.

He also added that it is great to use the tax system to make it affordable for everyone, but I think you still have to deal with supply and demand.

Enhancing CPP pensions...

Next year, the federal government will begin collecting the second level of CPP contributions to fulfill its commitment to enhance CPP payments for retirees, an effort that began in 2019.

Along with the annual increase in CPP contributions, the added second level means the employee's annual CPP payment will increase by $302 in 2024, raising the 2023 maximum of $3,754.45 to the 2024 maximum.

Comments